Texas tycoon is convicted of bilking $7B

Stanford ran 20-year Ponzi scheme

3/7/2012

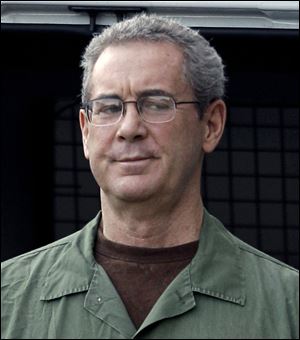

R. Allen Stanford was convicted Tuesday on 13 of 14 charges. He faces up to 20 years for the most serious charges.

HOUSTON -- Former Texas tycoon R. Allen Stanford, whose financial empire once spanned the Americas and made him fabulously wealthy, was convicted Tuesday of bilking his investors out of more than $7 billion through a Ponzi scheme he operated for 20 years.

A day after telling U.S. District Judge David Hittner they were having trouble reaching a verdict, jurors convicted Stanford on 13 of 14 charges he faced, acquitting him on a single count of wire fraud stemming from Super Bowl tickets he allegedly used to bribe a regulator.

Stanford, who was once considered one of the wealthiest people in the United States, looked down when the verdict was read. His mother and daughters, who were in the federal courtroom in Houston, hugged one another, and one of the daughters started crying.

"We are disappointed in the outcome. We expect to appeal," Ali Fazel, one of Stanford's attorneys, said after the hearing. He said he couldn't comment further because of a gag order Judge Hittner placed on attorneys in the case.

Prosecutors and Stanford's family members declined to comment, but one of his investors, Cassie Wilkinson, welcomed the verdict.

"As an investor, you have to doubt whether or not you were stupid or just taken advantage of. This relieves that doubt. It's a vindication," said Ms. Wilkinson, 62, who lives in Houston. She declined to say how much money she lost.

Stanford, 61, faces up to 20 years for the most serious charges against him. But if Judge Hittner orders him to serve his sentences consecutively, Stanford could get up to 230 years in prison.

Disgraced financier Bernard Madoff, by comparison, was sentenced to 150 years in prison for orchestrating the largest Ponzi scheme in history.

Prosecutors say Stanford used investor money to fund a string of failed businesses, bribe regulators, and pay for his lavish lifestyle.

During the more than six-week trial, prosecutors presented evidence they said showed Stanford orchestrated a 20-year scheme that bilked billions from investors through the sale of certificates of deposit from his bank on the Caribbean island nation of Antigua.