Patience pays off for local credit union

Latino service earns 1st rating from BauerFinancial, Inc.

6/17/2017It’s been a long road for Nueva Esperanza, the tiny credit union on Broadway in Toledo that has been trying to make a difference in the Toledo area Latino community. But after six years, its patience and persistence appears to have paid off.

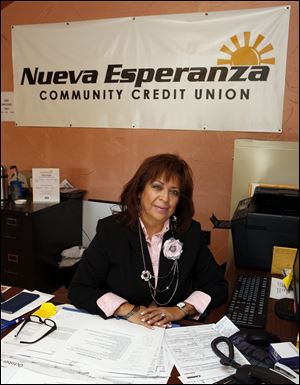

Sue Cuevas, CEO the Nueva Esperanza Credit Union, in 2012.

BauerFinancial Inc., an independent firm that rates financial institutions based on stability and strength, released its first quarter report on Thursday and gave Nueva Esperanza a three-star “adequate” rating.

The research firm, based in Coral Gables, Fla. rates banks and credit unions nationwide on a scale of zero to five stars, with zero the lowest and five being “superior.”

While “adequate” may not sound special, it is Nueva Esperanza’s the first rating of any kind since it began in 2010. It always had been designated “S.U.” for startup.

Karen Dorway, a BauerFinancial spokesman, said it takes time for banks and credit unions to gain the stability to be rated. Also, assets must exceed $1.5 million.

Nueva Esperanza’s assets exceed $1.8 million, but finally it has been in business long enough to be rated, Ms. Dorway said. “I think you can safely say they have (credibility) now,” she added.

Sue Cuevas, Nueva Esperanza president and CEO, said it’s pleasing to at last be rated by BauerFinancial.

“It’s interesting that they say that we now have credibility because we started with nothing, not even a policy or a loan on the books,” Ms. Cuevas said. “We’re still just a savings and loan with limited services at this point, so to get a three-star rating, I would have to say that’s pretty amazing,” she added.

Nueva Esperanza is moving this summer to a bigger space that will allow it to become a full-service credit union with a mortgage program, direct deposit, and more. “It’s taken a little bit of time, but you know … pride and passion,” Ms. Cuevas said.

Elsewhere in the quarterly report, one northwest Ohio credit union’s rating improved, but two others saw their ratings downgraded. The ratings of all other northwest Ohio banks and southeast Michigan banks and credit unions were unchanged.

Bay Area Credit Union in Oregon improved to five stars from a previous four, but Toledo Postal Employees Credit Union in Toledo and WoodCo Federal Credit Union in Perrysburg both dropped to four-star “excellent” ratings from a previous five stars.

Northwest Ohio has 26 banks — 22 that had five stars, three with four stars, and one with two stars. Of 47 credit unions, 24 had five stars, 14 had four stars, one had three stars, three had two stars, one had one star, and four were not rated.

Of southeast Michigan’s four credit unions, two had five stars and two had four stars. Of the three banks, two had five stars and one had four stars.

Contact Jon Chavez at: jchavez@theblade.com or 419-724-6128.