Payments to IRS short by billions

7/3/2011

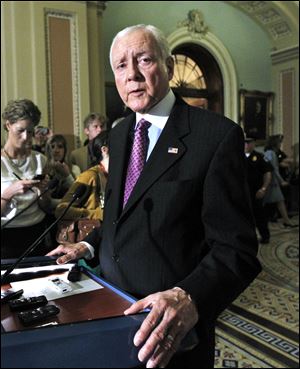

Sen. Orrin Hatch (R., Utah) says intrusive moves to close the gap would be "a price that a liberty-loving people ... are rightly unwilling to pay."

WASHINGTON -- At a time when higher taxes or deeper government spending cuts seem to be the only options available to close the gaping federal deficit, going after more than $400 billion a year in uncollected taxes should be a no-brainer.

But in the nation's capital, the so-called "tax gap" hardly rates a mention in the official discussion of America's fiscal woes.

In government parlance, the "tax gap" is the difference between the taxes owed and what's actually paid on time.

In their most recent analysis, from 2001, the Internal Revenue Service estimated that only about 84 percent of federal taxes were voluntarily paid on time that year, leaving a gross tax gap of $345 billion, or roughly 16 percent, uncollected.

Late payments and IRS collection efforts brought in $50 billion more, which cut the net tax gap to $290 billion in 2001.

But similar estimates point to a gross tax gap of $410 billion to $500 billion in 2010, said Benjamin Harris, a research economist at the Brookings Institution, a center-left research group.

"You could go a long way toward solving our budget mess by closing the tax gap, but the problem is, it's not easily closed," Mr. Harris said.

The IRS plans a new analysis of the tax gap this year or early next year, but the trends are clear.

In the past 20 years, the U.S. economy has grown more complex, blurring the lines between personal and business income and creating more opportunities for tax scofflaws.

Congress limits the IRS budget, and sophisticated tax cheats realize their chances of detection are relatively low. Others say that most who misreport their earnings do so inadvertently because of the complexity of the tax code.

More targeted IRS enforcement probably could cut the tax gap by 10 percent without any fundamental changes to the IRS, Mr. Harris estimates.

Cutting the gap further would require more thorough IRS reporting, increased tax withholding, and more money to boost enforcement for the IRS.

But the political will to bolster the IRS collection apparatus and turn it loose on American citizens does not exist.

"The government could close the tax gap entirely by putting IRS agents in every family's living room and in every small business. But this is a price that a liberty-loving people and their representatives are rightly unwilling to pay," said Sen. Orrin Hatch of Utah, the senior Republican member of the Senate Finance Committee, which helps write America's tax laws.

The Obama Administration wants to increase the IRS budget from $12.1 billion to $13.3 billion in fiscal 2012 and add 5,000 IRS agents.

About $240 million would go for "new, revenue-generating tax enforcement initiatives aimed at closing the tax gap," according to a Treasury Department budget request.

The measures would reap an estimated $1.3 billion in extra annual tax revenue by 2014.

But House Republicans, spurred by the anti-tax sentiment of Tea Party activists, voted to cut the IRS budget by $600 million in fiscal year 2012, citing the need to cut the budget deficit.

IRS Commissioner Doug Shulman told lawmakers that the proposed GOP cuts would cause tax collections to decline by $4 billion because they'd require slashing the agency's enforcement budget.

But Curtis Dubay, senior tax policy analyst at the Heritage Foundation, a conservative think tank, said Mr. Shulman was simply "posturing" to preserve IRS funding.

Strengthening IRS enforcement is a mistake, Mr. Dubay said, because "the tax gap is not the result of people illegally evading taxes. It's the result of an overly complex tax code that gets more and more complex every day."

Whether by willful evasion or unintentional mistakes, businesses and individuals failing to report, underreporting, or underpaying their taxes cause honest taxpayers to pay more -- about $2,200 apiece -- to make up the revenue shortfall.

That basic unfairness erodes confidence in the tax system, which lowers taxpayer morale and, in turn, increases noncompliance.

The biggest losers are America's wage earners and salaried workers, who pay an estimated 99 percent of their fair tax burden because their taxes are automatically withheld from their pay and reported by a third party, their employers.

But individuals with business income -- mainly self-employed, sole proprietors who get paid in cash -- misreport roughly 54 percent of their actual income by either underreporting it or claiming deductions, credits, and exemptions to which they aren't entitled.

"This is incredible," Mr. Harris said. "You kind of feel like a sucker as a wage earner. Here you are paying taxes because someone else is paying you, but if someone else is getting paid on their own, they pay taxes at half the rate."

These taxpayers escape an estimated $110 billion in taxes each year, according to 2001 IRS estimates.

Experts agree the amount has grown since then.

"And you can do all the audits you want, but this money is never going to show up," Mr. Harris said. "This is what makes the tax gap so hard to close."